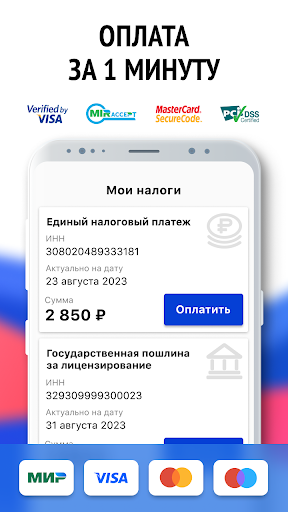

Taxes 2023: verification and payment of taxes for individuals, individual entrepreneurs and self-employed persons using TIN. Information about all taxes in the Unified Tax Account:

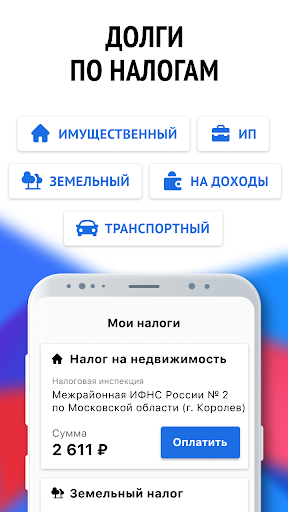

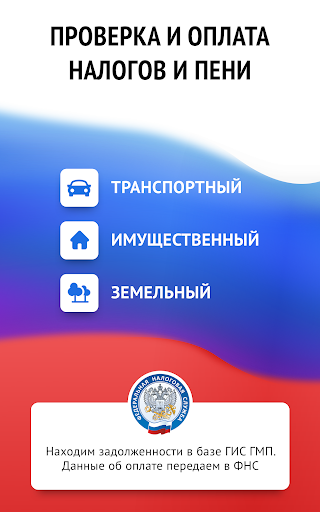

- Transport tax

- Property tax

- Land tax

- Income tax

- Health insurance tax - Health insurance

contributions -

Pension insurance contributions

- Patent tax

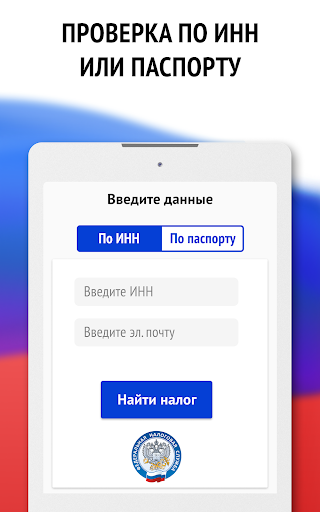

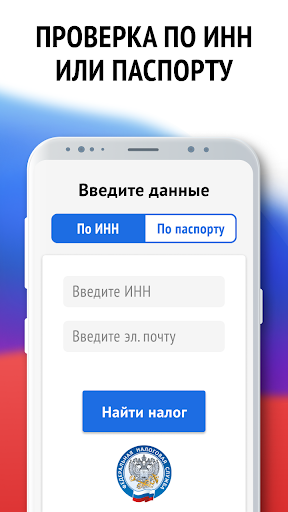

Checking taxes of the Federal Tax Service by TIN or UIN ( indicated on the tax receipt).

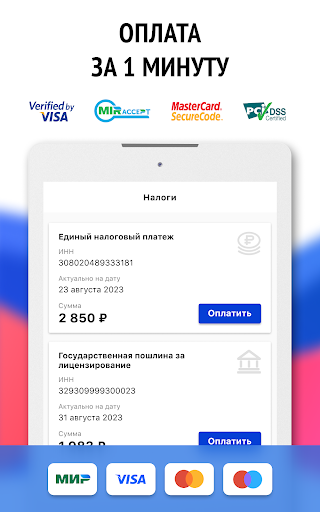

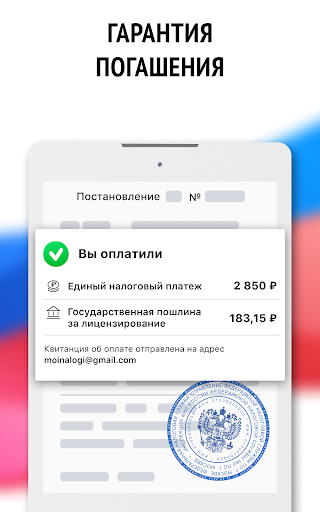

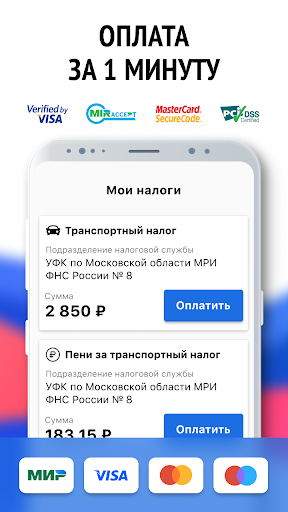

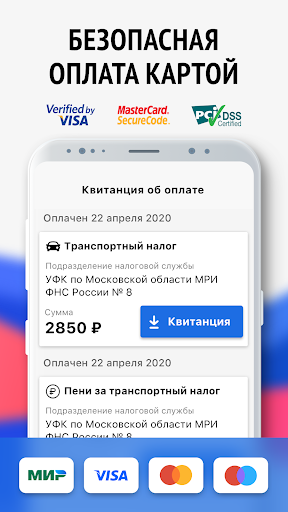

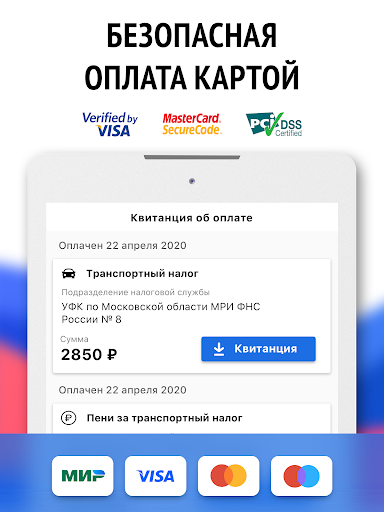

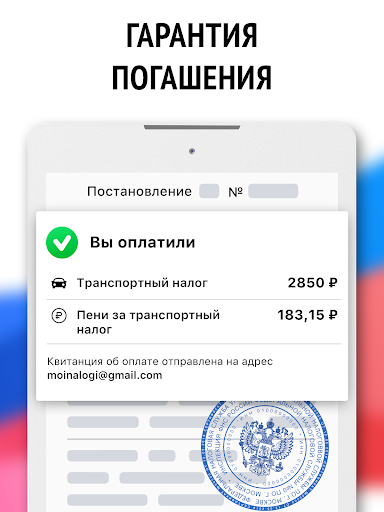

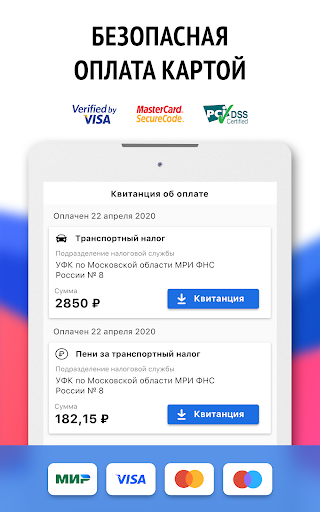

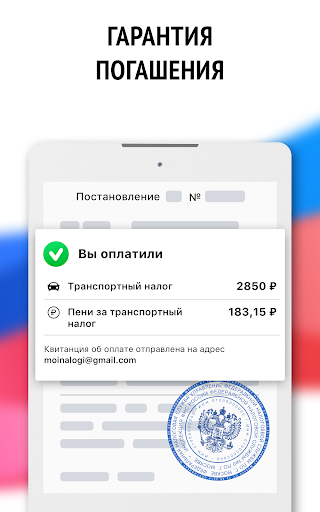

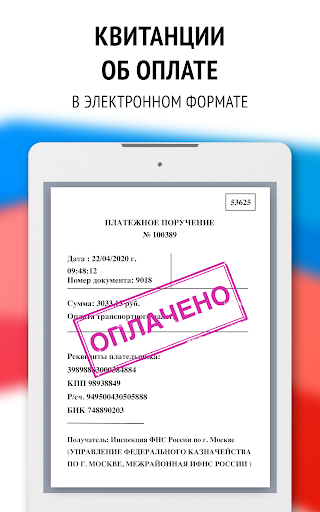

Payment of taxes to the Federal Tax Service online using VISA, MasterCard, Maestro and MIR cards.

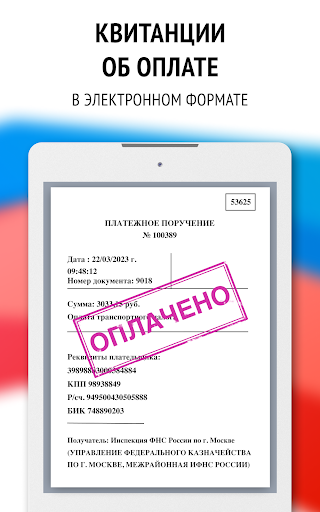

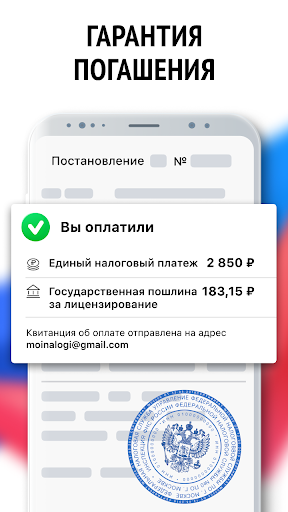

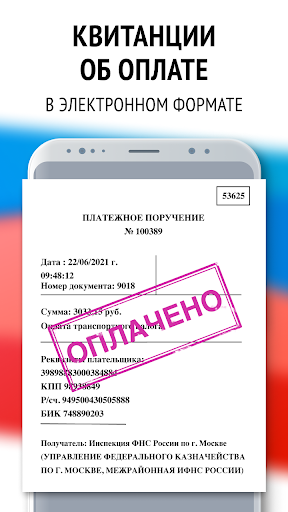

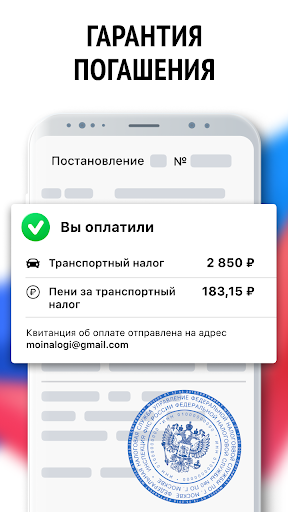

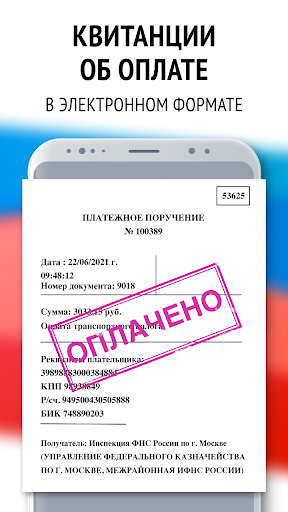

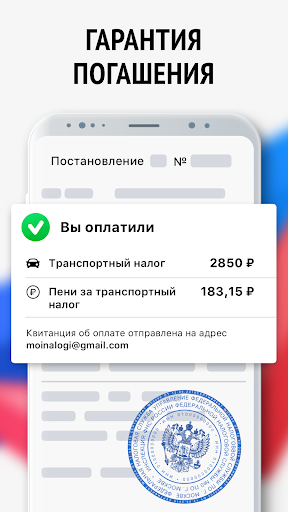

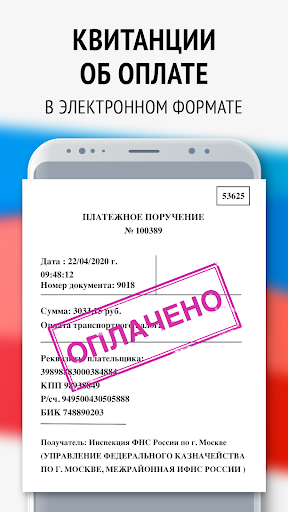

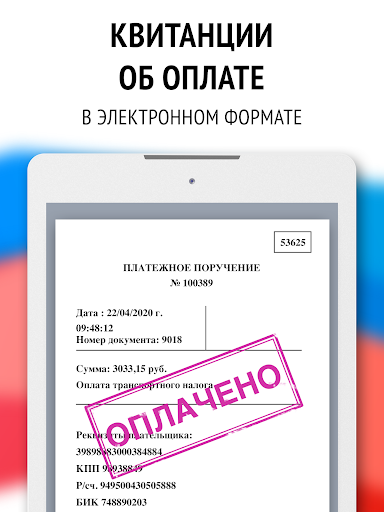

Bank receipts for payment of taxes.

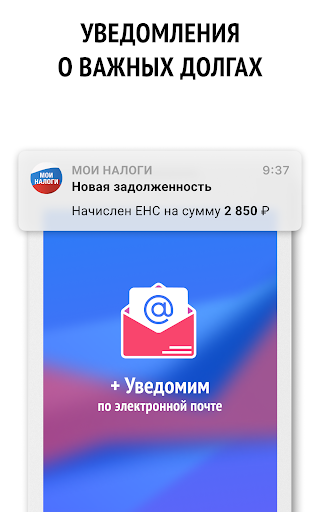

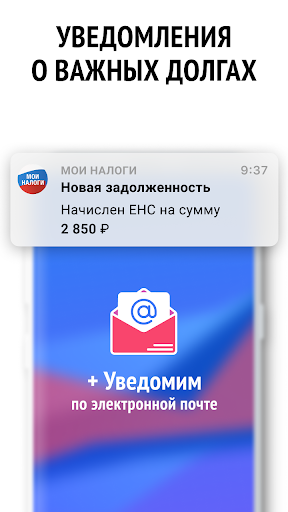

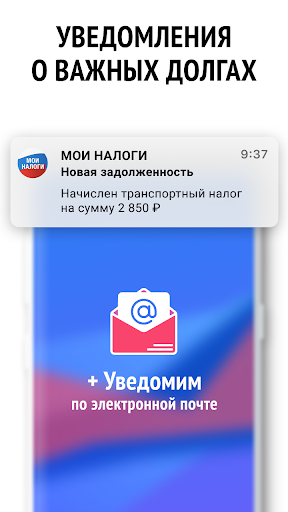

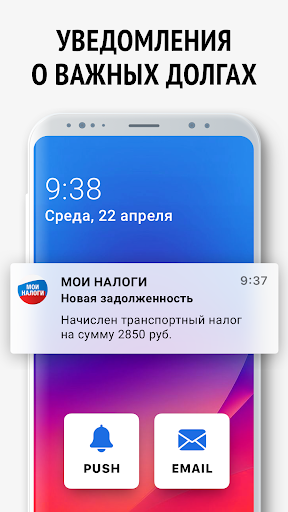

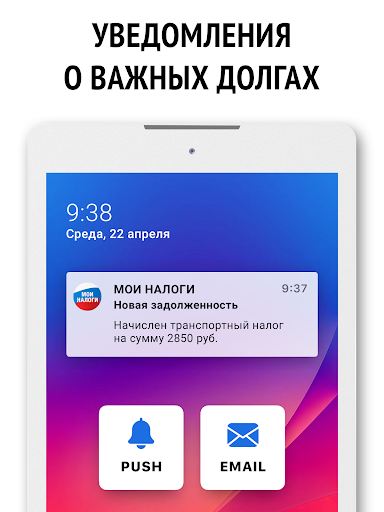

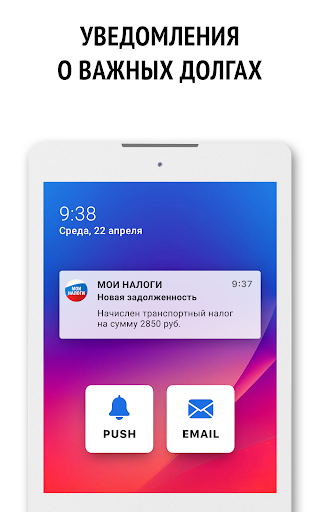

Notifications of tax debts to the Federal Tax Service in the application and by email.

Customer support for users.

Please note:

Taxes assessed in 2022 must be paid by December 1, 2023. In case of late payment, penalties are charged for each day of delay.

Through the application you can find and pay the following taxes: transport tax, property tax, land tax, income tax, health insurance tax, health insurance contributions, pension insurance contributions, patent tax, penalties for late payment of taxes (if you have them).

You can pay the 2023 tax using the UIN (it is indicated on the tax receipt). If you did not receive a receipt, you will be able to find and pay your tax ID after December 1, 2023. Until December 1, the TIN contains debts for previous years.

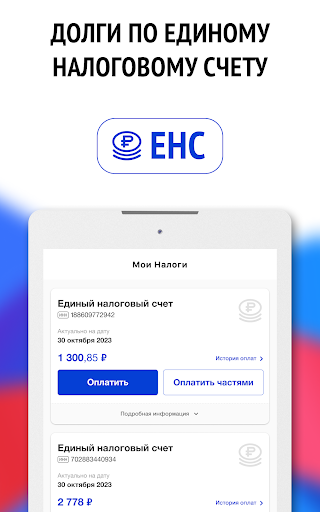

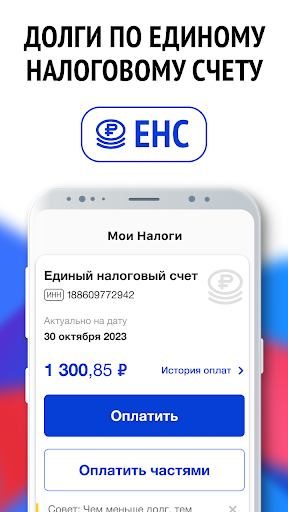

What is a Unified Tax Account?

This is an account in which the debts of a citizen or company to the budget are collected: taxes, contributions, penalties, fines and interest. When the taxpayer pays off these debts, it is also reflected in the account.

Don’t know your UIN or don’t have a tax receipt?

If you do not have a receipt for 2022 from the Federal Tax Service, check your taxes using your TIN now (you will find out if you have tax debts for previous years) and after December 1 (you will find tax for 2022 using your TIN).

Help

If you need help, write to us at support@avtonalogi.ru, we will be happy to help.

Usage Policy: https://r.shtrafy-gibdd.ru/docs/oferta_nalogi.html

Disclaimer

This is an application of a commercial, non-governmental service. It does not represent the Federal Tax Service or any other government organization.

Source of information

We receive information about taxes from the State Information System GIS GMP (https://roskazna.gov.ru/gis), access to which is provided by the NPO MONETA.RU (LLC) under an agreement on information and technical interaction with the developer. License of the Central Bank of the Russian Federation No. 3508-K dated July 2, 2012.

Приложение стало быстрее и удобнее и еще лучше уведомляет о налогах.

Minor bugs have been fixed, the application has become faster and more convenient, and provides even better tax notifications.

We have added the ability to pay taxes in installments. Now you can choose for yourself which part of the debt to pay and when.

We have added the ability to pay taxes in installments. Now you can choose for yourself which part of the debt to pay and when.

The transition to ENS is complete! The application has been restored! Thank you for your patience and we hope you continue to use our app!

The transition to ENS is complete! The application has been restored! Thank you for your patience and we hope you continue to use our app!

Switching to the UNC is complete! The application has been restored! Thank you for your patience and we hope you continue to use our app!

The transition to the ENC is complete! The application has been restored! Thank you for your patience and we hope you continue to use our app!

Мы добавили возможность оплачивать налоги отдельно от пеней. Это поможет избежать доначисления пени. А также обновили дизайн, что делает приложение более удобным и понятным.

Если у вас остались вопросы, напишите нам на support@avtonalogi.ru

Теперь мы находим не только Транспортный, земельный, имущественный налоги, но и:

Налог на доходы

Налог на профессиональный доход

Взносы на медицинское страхование

Взносы на пенсионное страхование

Штрафы за налоговые правонарушения

Налог на патент

Узнавайте о налогах и гасите их вовремя!

Есть еще проблемы? Напишите нам на support@avtonalogi.ru

Теперь мы находим не только Транспортный, земельный, имущественный налоги, но и:

Налог на доходы

Налог на профессиональный доход

Взносы на медицинское страхование

Взносы на пенсионное страхование

Штрафы за налоговые правонарушения

Налог на патент

Узнавайте о налогах и гасите их вовремя!

Есть еще проблемы? Напишите нам на support@avtonalogi.ru

- Добавлен более удобный функционал ввода данных для проверки задолженностей.

- Улучшен экран отображения налогов.

Если у вас остались вопросы, напишите нам на support@avtonalogi.ru

vivo Y51

vivo Y51